property tax calculator frisco tx

Groceries are exempt from the Frisco and Texas state sales taxes. Sales Tax State Local Sales Tax on Food.

Taxes Celina Tx Life Connected

View more property details sales history and Zestimate data on Zillow.

. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration.

4 beds 25 baths 2323 sq. NTREIS For Sale. Enter your Over 65 freeze year.

Enter the value of your property. Those property owners living in Denton County will still receive 2 statements. Please select your county.

This mortgage calculator can be used to figure out monthly payments of a home mortgage loan based on the homes sale price the term of the loan desired buyers down payment percentage and the loans interest rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Property Tax Rate NOTICE - Adoption of FY21 Tax Rate PDF Notice of 2020 Tax Rates PDF City of Frisco Tax Rates For Fiscal Year 2021.

469-362-5800 Hours Monday through Friday 8 am. To avoid penalties pay your taxes by January 31 2022. How to Get Your Taxes Reduced for Free.

Please select your city. 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone. That being said Texas does fund many of their infrastructure projects etc.

Property Tax Rate Comparisons around North Texas. 1129 Bentgrass Dr Frisco TX 75036 800000 MLS 20019930 Meticulously cared for North facing Landon home in the highly sought after neighborhood. Enter your Over 65 freeze amount.

For example the Plano Independent School District levies a 132 property tax rate and the Frisco Independent School District levies a 131 property tax rate. Pin By Business Directory On Minnesota Nature Garland Tx Beauty Services Financial Services. Enter the value of your property.

Enter your Over 65 freeze year. Homeowners in these areas should remember to claim the homestead exemption. This is quite appealing to those relocating from many other states around the nation.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. 5 beds 45 baths 3678 sq. The Frisco Sales Tax is collected by the merchant on all qualifying sales made within Frisco.

The Collin County tax bill now includes Collin County City of Frisco Frisco ISD and Collin County Community College district taxes. Enter your Over 65 freeze amount. At this point property owners usually order service of one of the best property tax attorneys in Frisco TX.

9924 Corinth Ln Frisco TX 75035 599900 MLS 14752088 Beautiful one-story home located in Crown Ridge rated a 5 Star Gold Standard neighborhoo. Plano Texas and Frisco Texas. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years.

15910 Trail Glen Dr Frisco TX 75035-1651 is a single-family home listed for-sale at 495000. This calculator factors in PMI Private Mortgage Insurance for loans where less than 20 is put as a down payment. Enter your Over 65 freeze amount.

Real property tax on median home. Property Tax Calculator Frisco Rmends Raising Property Taxes Texas Scorecard Frisco Property Taxes PISD adopts same tax rate for fifth year in a row Plano Star Courier starlocalmedia School Board Drops Tax Rate for Third Straight Year Frisco property tax rate to remain unchanged for 2020 What Is The Property Tax Rate Frisco Heres a new. Property Tax Statements are mailed out in October and are due upon receipt.

Monday through Friday except holidays 8 am to 430 pm New Resident Services and Title transfers will only be processed between the hours of 8 am and 4 pm Monday through Friday. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Please select your city.

This type of an agreement means the cost you pay is restricted to a percentage of any tax. Please choose your exemption. School Board Drops Tax Rate for Third Straight Year Frisco Property Taxes Frisco Rmends Raising Property Taxes Texas Scorecard Frisco property tax rate to remain unchanged for 2020 PISD adopts same tax rate for fifth year in a row Plano Star.

Please select your school. The Frisco Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Frisco local sales taxesThe local sales tax consists of a 200 city sales tax. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. Mary and Jim Horn Government Center. One of the fantastic things about living in Texas is the absence of a state income tax.

2022 Cost of Living Calculator for Taxes. Youll pay only when theres a tax. For more information call 469.

Youll pay only when theres a tax decrease when you join with protest firms on a contingent fee basis. Home is a 4 bed 30 bath property. Property tax calculator frisco tx Monday February 28 2022 Edit.

This home was built in 2020 and last sold on 142021 for 400000. Property tax calculator frisco tx Monday February 28 2022 Edit. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Pay property taxes on time. Enter your Over 65 freeze year.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Why Are Texas Property Taxes So High Home Tax Solutions

Transfer Tax Calculator 2022 For All 50 States

Look Here You Can See All Single Story Homes Located In Prosper Frisco And Surrounding Areas You Can Vie New Home Construction Single Story Homes Level Homes

Budget And Tax Facts City Of Lewisville Tx

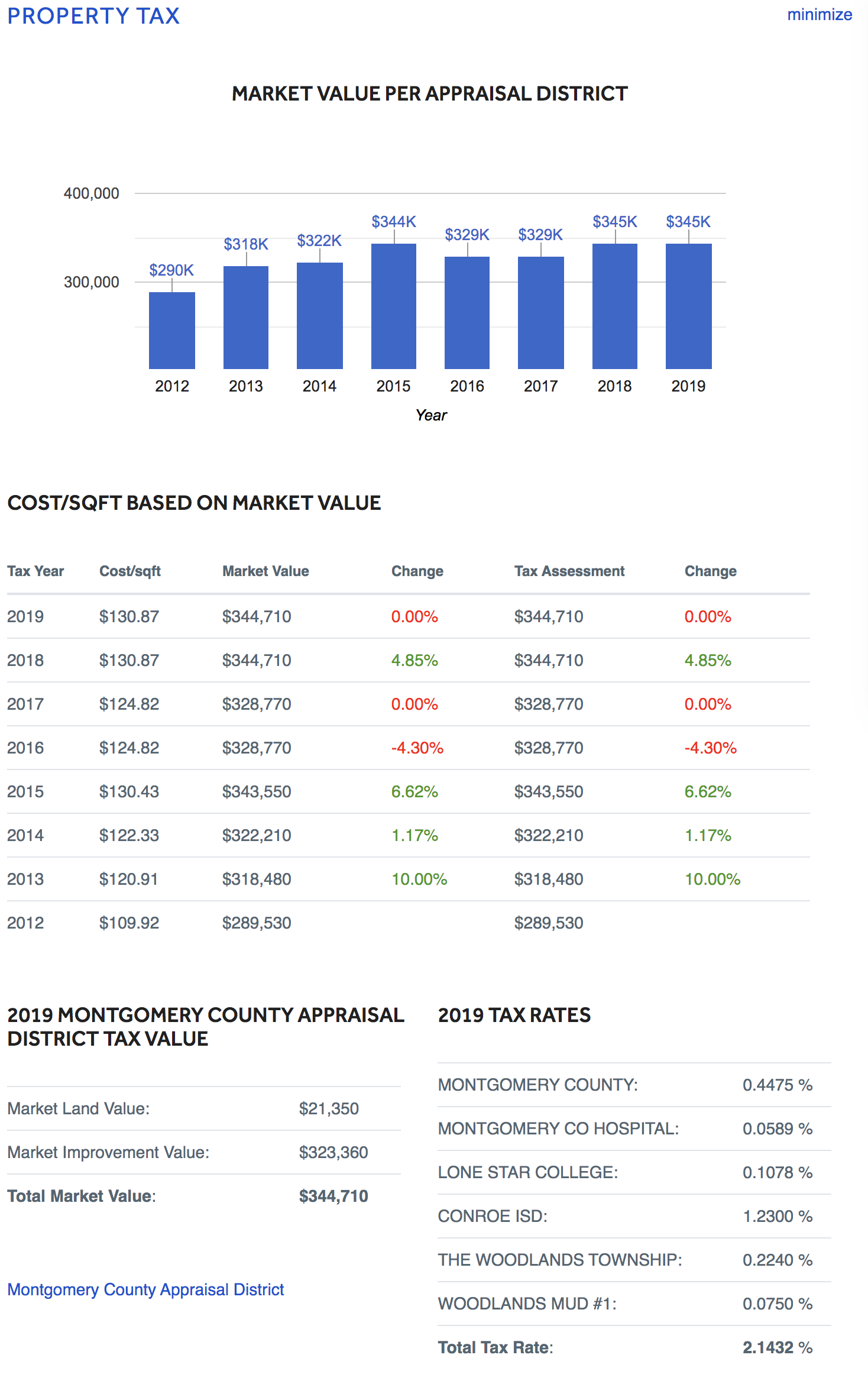

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

What Is The Rule Of 72 Debt Relief Programs Collateral Loans Consolidate Credit Card Debt

What Is The Property Tax Rate In Frisco Texas

Perspective Owning Real Estate Under An Llc Has Advantages But It Can Be Costly Holding Company Limited Liability Company Offshore

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Budget And Tax Facts City Of Lewisville Tx

Where Are Lowest Property Taxes In North Texas

5 Tax Deductions When Selling A Home Selling House Tax Deductions Selling Your House

Homes Located In Top Notch Rated School Zones At The Home Solutions Realty Group We Know How Important It Is To Have Home Buying Fox Home Houston Real Estate